Owed money? Tired of not being paid on time, or sometimes not at all? It’s Thursday afternoon, and you have employees to pay, but not enough money in your bank account for payroll. If only you could collect some of the money you are owed for the materials you have already supplied. Enter the lien. A materialmen’s lien is the leverage you need to make sure you get paid. Did you know that correctly following the lien process in your state is the key to writing off less than 1% of your gross revenue?

For a lien to be effective, you must send all the required notices and file them on time, and correctly. Not one mistake can be made! After you implement the proper lien and collection strategy, your Thursday afternoons will become the most relaxing day of the week because you will never have to stress about not being able to make payroll again.

As a Material Supplier in the construction industry, you have such great leverage to secure any amount you are owed with a lien. But what is a lien? A lien gives you a claim to ownership in the property where your materials were used, to the extent of the value of the materials you supplied. A lien gives you an ownership interest in the property. The only other industry that gets that type of interest are lenders, who provide you with money to get an asset. Whether that asset is a house or a car, that lender has a lien (an ownership interest) to the extent of the money that is owed.

A lien is essential to a Material Supplier. In order to have such an extreme remedy, you must follow all the rules perfectly. If you miss one step, not only will you lose the right to collect the money you are owed, but you could also have to pay someone else’s attorney fees or a penalty for removing a lien that isn’t filed properly.

Our dedicated lien department at The Cromeens Law Firm is here to help you with all your lien efforts. Call us today to secure your right to payment. It’s just that simple!

The rules and steps for a valid lien are different in all 50 states. Although the timing and the steps vary in each state, a commonality with all 50 states is that notice is always required. The money flows down what I like to call “the construction food chain” and you need to give notice at the top to secure your right to payment.

If you find that there is an issue with cash flow and the money isn’t making it down the chain to you, there is a kink in your cash flow hose! As a Material Supplier, you are very removed from the Owner, aka the flow of the money. What every state has in common is that they give the Owner a chance to pay before a lien is filed. This is accomplished by sending a notice to the Owner and General Contractor that you are owed money and have not been paid.

Remember, you can never send a notice too early; however, there is a penalty if a notice is sent late. As soon as you realize there is an issue, and you think you are not going to get paid, send notice to the Owner and General Contractor. The purpose of the notice is twofold; it gives the Owner a chance to pay before a lien is filed against their property. In addition, it gives the Owner a chance to make sure you are paid before they pay whoever ordered the material, so they don’t have to pay twice. It is incredibly important you understand what is required to have a valid lien in your state.

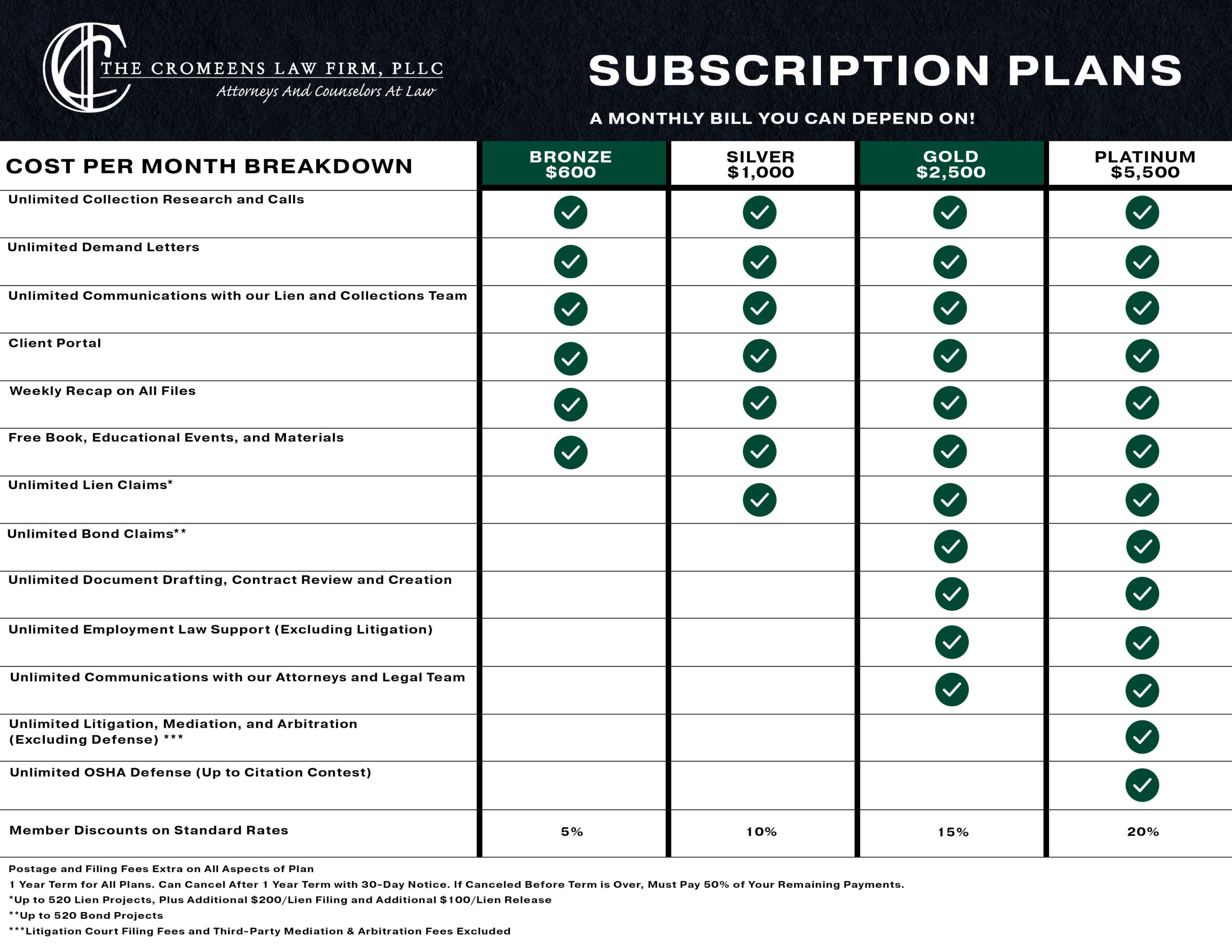

If you want to know the lien process for your state, give our construction lawyers a call and we will walk you through the process at no charge. We do offer the service to file your liens for a flat monthly fee as well as a monthly subscription. Our firm offers a multitude of payment options to fit your budget and save you money.

You can protect yourself and your business. Save time and your hard-earned money by educating yourself and teaming up with our construction attorneys at The Cromeens Law Firm. We believe in the proactive approach to protecting your business. Remember to sign up for our free webinar – C.Y.A. for Material Suppliers, Thursday, May 13th, at 12 PM. Ieshia Dunmore will teach you how to best protect yourself and your business. We look forward to seeing you then!

Karalynn Cromeens is the Owner and Managing Partner of The Cromeens Law Firm, PLLC, with over 17 years of experience in construction, real estate, and business law. A published author and passionate advocate for contractors, she has dedicated her career to protecting the businesses her clients have built. Karalynn is on a mission to educate subcontractors on their legal rights, which inspired her books Quit Getting Screwed and Quit Getting Stiffed, as well as her podcast and The Subcontractor Institute.